The Benefits of Open Banking

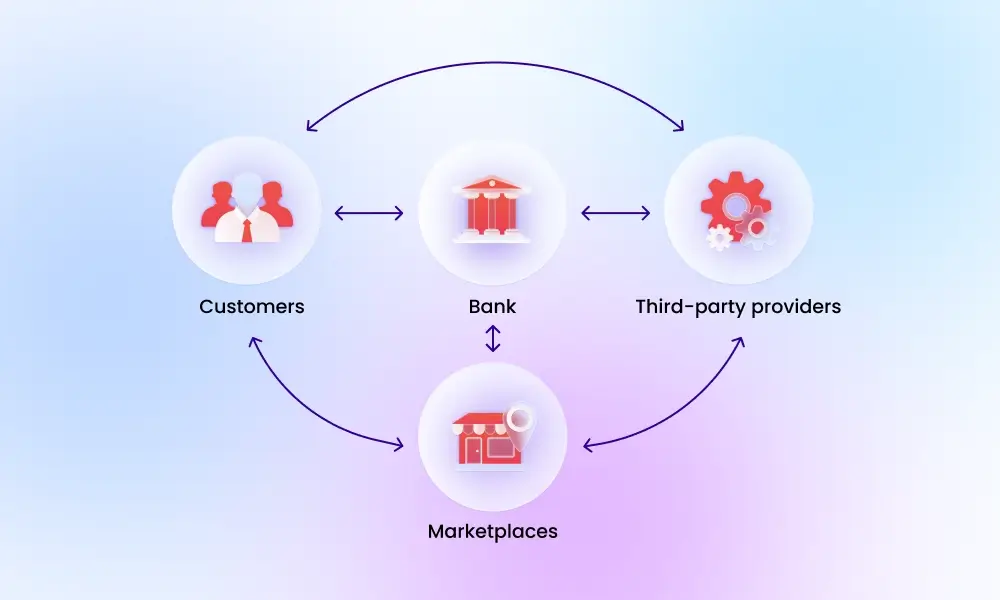

Open banking is a relatively new concept that has transformed the financial industry and many areas of life in recent times. Open banking can bring a host of benefits for both consumers and banks by creating a more interconnected financial ecosystem. Essentially, open banking involves using application programming interfaces (APIs) to enable third-party financial companies to access consumer data (with their permission). This can provide consumers with many more services at their fingertips and give banks and other financial institutions the ability to enhance the customer experience. This post will explore the main benefits of open banking and how it is changing the landscape.

Holistic Overview for Consumers

One of the biggest benefits of open banking from a consumer standpoint is that it can provide a holistic overview of their finances. Open banking allows consumers to view their accounts in a single, easy-to-use platform, which allows them to easily track their spending, savings, and investments. This can help consumers make smarter financial decisions and improves the user experience.

Personalization

Open banking can also facilitate personalization, with financial institutions being able to utilize data to develop products and services that align with individual customer needs. Banks and other financial institutions can provide financial products based on spending habits and credit, create targeted offers, and improve credit assessments. This benefits the consumer with products and services tailored to their needs and gives banks the ability to improve their offerings. An open banking API platform is a useful tool for banks and other organizations with the ability to form partnerships with other financial companies and expand their offerings. This allows banks to easily innovate and improve their products/services, which makes it much easier to attract new customers and retain existing ones.

Greater Financial Inclusion

Open banking is changing the financial landscape in many ways, including by improving financial inclusion. Open banking can help those in difficult situations get access to credit and financial services by utilizing alternative data, such as rent and utility bills. This can help build credit profiles for those who may not qualify and give people access to loans and other important financial services.

Greater Security

Cybersecurity is a huge talking point in the financial industry with cyber attacks on the rise and financial institutions among those most heavily targeted for obvious reasons. Open banking can help to improve cybersecurity standards as there are strict regulations in place to protect consumers. This means that financial institutions are required to develop strong security protocols, including the use of data encryption and multi-factor authentication (MFA). Users also have control over who can access their data and for what purposes, providing transparency and the ability to change settings with ease.

These are a few of the main benefits of open banking, but there are others too. Open banking has transformed the financial landscape in recent years by creating an interconnected financial ecosystem. This benefits consumers by giving them the ability to get a holistic overview of their finances and easily access new products and services, while banks and other institutions can use open banking to innovate and improve their offerings.